Immigrant Visa

Immigrant Visa

Immigrant Visa

- FORMS

- N-400, Application for Naturalization

- I-485, Application to Register Permanent Residence or Adjust Status

- I-130, Petition for Alien Relative

- I-864, Affidavit of Support Under Section 213A of the INA

- I-90, Application to Replace Permanent Resident Card

- I-9, Employment Eligibility Verification

- I-765, Application for Employment Authorization

- Arrival/Departure Forms: I-94 and I-94W

- Apply for Citizenship

-

Green Card

Apply for a U.S. Visa

Financial

Pay1040.com – IRS Authorized Payment Provider

The trusted and secure way to make personal and business tax return payments to the IRS with your credit/debit card for a low fee.

NY Payment -Department of Taxation and Finance

Enter your username and password and select Sign in. If you don’t have a New York State Tax Department Online Services account, return to the Online Services page and select Create Account. All online services that require your personal information are secure. Please do not bookmark this page.

Disaster Loan Assistance

Disaster Loan Assistance – Login

Misc Program

For download Whatsapp web Scan QR Code or Click Link  https://www.whatsapp.com/download/

https://www.whatsapp.com/download/

IRS FORMS

Money Magazine

Money Magazine offers an online edition that is a great resource for financial information.

Unemployment Insurance Benefits

Unemployment Insurance Benefits

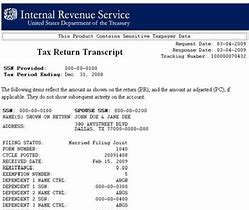

Welcome to Get Transcript

Welcome to Get Transcript

Tax Transcripts are only available online.

Governmental

Social Security Online

The Official Website of the U.S. Social Security Administration.

FOOD STAMPS APPLICATION

FOOD STAMPS APPLICATION

U.S. Small Business Administration

Small business programs and services to help you start, grow, and succeed.

NYC Food Delivery Assistance The City of New York is providing assistance to New Yorkers during the COVID-19 crisis by delivering meals to those who cannot access food themselves.

Who is this for?

This website is intended for individuals and families who meet all of the following criteria as a result of the COVID-19 emergency:

- No members of the household can go out and get food because they are at increased medical risk or homebound

- No neighbors or family members can go out and get food for you

- Do not receive meal assistance from other providers (incl. Meals on Wheels or God’s Love We Deliver); and

- You are unable to afford meal delivery or grocery delivery

Households that qualify may place an order every 48 hours. No orders may be placed between the hours of 11AM Friday and 11AM Saturday and no deliveries will be made on Sundays. Orders placed before 11AM will be delivered within two days of the order date. Orders placed after 11AM will be delivered within three days of the order date. Each order will contain two days of meals (4 meals per person in the household, but no household will receive more than 8 meals per delivery). If you don’t meet all of the eligibility criteria above you can still get help. To find food options in your area now you can visit the link below to see the local food pantry, soup kitchen, senior center, or SNAP enrollment sites near you. NYC.gov/getFood

Already have an account? Login here to complete your next order.

News

MSNBC – Microsoft & NBC

MSNBC is the place for up to the minute news. Many of the news articles have audio and video clips.

Wall Street Journal

Complete financial news service offers personalized news and market quotes. Plus, links to Barrons Online and Smart Money Interactive.

Selft-Employment

Uber Drive Login

Uber Drive Login

Lyft Drive Login

Lyft Drive Login

Tax

The Internal Revenue Service

Home of the IRS on the Web. The IRS has definitely done a nice job on their Website.

(FD) Check IRS Refund Status

(FD) Check IRS Refund Status

Track your tax return through the IRS website.

New York Department of Taxation and Finance

New York Department of Taxation and Finance

State Department of Revenue

Income Tax Refund Status for New York

State Tax Refund Link

Where’s My Refund NJ Division of Taxation?

You may use our online service to check the status of your New Jersey Income Tax refund.

To do so, you must know the:

- Social Security number listed first on your tax return; and

- Exact amount of your refund.

You should only use the Online Refund Status Service if you filed your return at least 4 weeks ago (electronically) or 12 weeks ago (paper).

Refunds for Tax Year 2019 will be issued on or after March 2, 2020.

To determine the status of your Personal Income Tax refund for the current tax year, you will need:

- Your Social Security Number; and

- The amount of your refund.

If you are looking for information about a prior tax year refund (or) Questions in general, please contact the Department through our Online Customer Service Center.

How Reprinting a Check in the Drake Software

I printed a check, but the information printed is not aligned correctly. Is there a way I can reprint the check?

If the original check printed was backwards, misaligned, or damaged it may be reprinted.

If the check was lost or stolen, however, you will need to contact the bank with whom you are partnered as soon as possible. Each bank has a different protocol for replacing a lost or stolen check. See the Notes below for the telephone numbers for ERO assistance for each banking partner.

In order to reprint a check Click Here

Information You’ll Need

Does My Child/Dependent Qualify for the Child Tax Credit or the Credit for Other Dependents?

This interview will help you determine if a person qualifies you for the Child Tax Credit or, starting in 2018, the Credit for Other Dependents.

- Your filing status.

- Whether you can claim the person as a dependent.

- The person’s date of birth.

The tool is designed for taxpayers that were U.S. citizens or resident aliens for the entire tax year for which they’re inquiring. If married, the spouse must also have been a U.S. citizen or resident alien for the entire tax year. For information regarding nonresidents or dual-status aliens, please see International Taxpayers.

Disclaimer

Conclusions are based on information provided by you in response to the questions you answered. Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404(f) of the Internal Revenue Code.

Estimated Completion Time: 10 minutes

Please Note: After 15 minutes of inactivity, you’ll be forced to start over.

Caution: Using the “Back” button within the ITA tool could cause an application error.

Earned Income Tax Credit (EITC) Assistant – Filing Status

Who Can Claim EITC?

Find out if you are eligible for the Earned Income Tax Credit. To get the EITC, you must meet requirements based on your filing status and income.

This tool helps you find out:

- Your filing status

- If you have one or more qualifying children

- If you are eligible

- The estimated amount of your credit

Modal Help: We provide helpful information by using modals. We show them in blue and a dotted-underline.

Upon completion of the tool, you will have the option to view or print a summary of the information you gave us, your filing status, your income, the number of qualifying children, if any, and an estimate of your Earned Income Tax Credit.

Your Citizenship

Generally, you must be a citizen or resident of the United States to claim the EITC. Resident aliens are taxed in the same way as U.S. citizens. A U.S. citizen or resident alien is subject to U.S. tax on the person’s worldwide income and must report it on a U.S. income tax return. A resident alien determines filing status, deductions, and credits in the same way as a U.S. citizen.

Curso de Capacitación de Diligencia Debida para los Preparadores Remunerados

El Curso de Capacitación de Diligencia Debida para los Preparadores Remunerados le ayuda a usted, como un preparador de impuestos, a entender mejor el Crédito Tributario por Ingreso del Trabajo (EITC, por sus siglas en inglés), el Crédito Tributario por Hijos (CTC, por sus siglas en inglés), el Crédito Tributario Adicional por Hijos (ACTC, por sus siglas en inglés), el Crédito por Otros Dependientes (ODC, por sus siglas en inglés), el Crédito Tributario de Oportunidad para los Estadounidenses (AOTC, por sus siglas en inglés) y el estado civil de Cabeza de Familia (HOH, por sus siglas en inglés) y sus responsabilidades, bajo los reglamentos de Diligencia Debida del preparador remunerado.

Welcome to Adams® Tax Forms 1099-Misc Online

ITIN CERTIFY AGENT

BECOME CERTIFYING AGENTS: ENROLLMENT BEGINS MAY 1ST 2015, THROUGH AUGUST 31, 2015.

First step is to complete the training.

THIS TRAINING IS REQUIRED FOR ALL NEW AND RENEWING

APPLICANTS. The training session is available online and the official certificate of completion of the training must be submitted along with the application.

Below are two helpful links for the training:

Second step in becoming an IRS (ITIN) Certifying Acceptance Agent is to fill out the form 13551 which will only be accepted during the open season; May 1st 2015, through August 31, 2015

The form can be found on the IRS website: http://www.irs.gov/pub/irs-pdf/f13551.pdf

WHERE TO APPLY

Send Form 13551, along with your completed fingerprint card or evidence of professional status if required, forensic documentation, and mandatory training certification to:

Internal Revenue Service

3651 S. IH 35

Stop 6380AUSC

Austin, TX 78741